ThinkCoin is a digital commerce token that supports the TradeConnect network. By bringing trade to blockchain, ThinkCoin lets you trade forex, commodities, stocks, and other financial products in a simple, safe, and easy-to-use way. You can obtain TCO through our pre-ICO and ICO release stages, once ICO is completed, by redeeming fiat currency and other cryptocurrencies through selected exchanges.

MORE complete about ThinkCoin?

- ThinkCoins securities or token utility

Token ThinkCoin is really a token utility. They are designed for use on the TradeConnect network and have no intrinsic value or rights.

- exchange ThinkCoins for fiat or other cryptocurrency

Post ICO, ThinkCoin token will record on some exchanges where they will be able to be bought, sold or exchanged.

- also features the following benefits:

The ThinkCoins collection will be used to trade in the upcoming TradeConnect trade network.

The economic tokens will be made for most of our Trading Fees back to the TradeConnect community.

- criteria for success

To develop the TradeConnect network, we are targeting to reach $ 5,000,000 through the ICO period.

If we are unable to collect this amount or more, funds made by the participant will be refunded.

- announced on blockchain

The modern derivative market requires transactions and ensures high speed and to achieve a high level of liquidity is required to ensure that trade is to be carried out.

Blockchain ethereum, however, has levels that make this difficult. If we consider any trade as free contract, it will require replacement of the same thing as the partner wants.

This library will charge significant costs to the entire ecosystem. Simple trading will require two parties to conduct an ethereum transaction:

- Market Maker that offers their trade

- Counterparty - Market Taker - then accepts the offer

This is because it will result in a minimum transaction time equal to the time to mine two blocks. in practice it means the transaction takes tens of seconds. This does not meet the expectations of the modern market. To resolve this issue, we will link trades created and preserved off-chain once the trade is complete. Free and get to blockchain along with transactions. Settlement

we will give a little news of Tim ThinkCoin with Brian Kelly who runs BKCM Capital in New York and host CNBC Fast Money. # Token2049 # ThinkCoin @ token2049

Global financial markets are dominated by banks and other financial institutions, some of which are less transparent. have undue influence on global asset prices and may impose unfair charges.

New technology means we can now provide greater transparency and accountability for all market players whose established financial players have failed to take chances in blockchain technology and still use centralized book orders to control price and trade other limitations including:

- trading does not make credit and peer-to-peer financial risks

- lack of transparency in price creation and trade execution

- trading and fund settlement can take days versus seconds in blockchain

- lack of flexibility in transferring trades

Solution

We are developing TradeConnect: a state-of-the-art block-based trading network that will enable trading of any financial assets in the world. Our order software will allow individuals and institutions to trade directly with one another, creating a balanced playing field in which big and small players trade as equivalents. Trading will be verified on blockchain, which means settlement can be completed in seconds instead of days - changing trades forever.

Why Invest in TradeConnect

Because it would disrupt a market dominated by banks, frontline brokers, and large funds, creates a great opportunity to be the leader of many commercial network assets based on chain blocks to market a wide range of financial product products not found in traditional cryptographic exchanges.

Initially focusing on the retail sector, the network will be expanded to

market of institutional and corporate derivatives trading, and then to a series of other financial sectors.

In the end, negotiation solutions will enable clients to operate financial products with any partner using the blockchain-agnostic platform or public broker.

Features:

- Trust, integrity and visibility of the accounting ledger chain.

- Ability to maintain and complete funds in blocking chains

- Speed of processing usage outside the chain is higher

- Private ledgers under a consortium can only be seen by participants in a network combined with a public block chain.

Important Benefits for Users

- Connection fees: Instead of traditional commission rates set by brokers or agencies, TradeConnect will charge the connection fees paid in TCO that all participants will pay in transactions and partly to the network for ongoing maintenance and development. Distribution of connection fees will be 50% for creators, 25% for users and 25% for TradeConnect networks. In this way, the traders who make the market are encouraged to participate in the TradeConnect economy and to support it at the same time.

- Margin Lending: TradeConnect will create a structured margin loan model consisting of qualified margin lenders that have enough assets, credit and liquidity to offer margin loans and stable lending rates in the mid-market. This rate will be set every day by a consortium of margin lending vendors checked on the network. Suppliers may set a level higher or lower than the benchmark, within a 1-5% tolerance of the benchmark to avoid price manipulation.

- Digital person: In a centralized negotiation model, the underlying negotiations are not "seen" by market participants, regardless of price, time, size and assets traded. Digital People of TradeConnect labels each unique customer in a unique ranking network and, over time, creates a profile that enables market makers and users to bid for the right type of carrier. This "auction" enables liquidity providers in the network to pay more for the correct type of operation and, as a result, reduce their overall expenses. For each successful auction, the network maintains an additional spread percentage offered by the Creator at the auction. This profile monetizes scores and values for the network.

- Token List: The network initially will support the most liquid cryptocurrency as collateral, depending on market size and available liquidity in the market. The TradeConnect portfolio will initially support Bitcoin, Bitcoin Cash, Ethereum, Dash, Monero, LiteCoin, ThinkCoin (TCO). All cryptoactives will be protected through their association with BitGo, which has a strong offer of institutional prisoners with advanced treasury and security controls. A strong BitGo API will allow further development of internal controls to sign and audit transactions.

Our mission

Transactions anchored in models and structures that have been decades old. While ThinkMarkets, our parent company, has experienced an explosion in the world, new technology has given us new opportunities in financial services, allowing us to consolidate our position at the forefront of innovation. At TradeConnect we have developed a trading network where the latest AI technologies and revolutionary new block power chains combine to unlock the bargaining hardship of legacy practices. ThinkCoin, the encryption currency that will ultimately run the trading of any financial asset, allows you to run various kinds without transaction history. We will use new technology to develop a network that offers a level of flexibility that the market has never seen before.

The principle of the platform

ThinkCoin aims to solve the above problems by creating the most sophisticated peer-to-peer trading network called TradeConnect. TradeConnect will enable you to trade any financial assets in the world.

The TradeConnect special software will allow individuals and institutions to trade directly with each other, which will lead to a balanced playing field where wholesalers and small traders can trade on the same footing. With ThinkCoin, all transactions are checked on a block chain, which means that completion can be completed in seconds rather than days.

The TradeConnect ecosystem will revolve around the use of ThinkCoin, which is described as "the digital commerce token underlying the TradeConnect network."

By using ThinkCoin, you can trade your forex, products, stocks and other financial products with your peers in a simple, safe, and easy-to-use way.

ThinkCoin is specified under TCO symbol. You can buy TCO during pre-ICO and ICO companies. They sell TCO in exchange for currency and currency crypt. After the sale of tokens, TCO will be available for purchase on various exchanges.

Alpha TradeConnect is planned to be released in April 2018. By the end of the year, TradeConnect is committed to having been allowed to work as a licensed exchange in the United States. In July 2019, the company intends to conduct an IPO (yes, IPO, not ICO).

token information:

Name: ThinkCoin (TCO)

Total budget: 500,000,000

Total Allocation: 300,000,000

Hard Cap: $ 30,000,000 USD

Soft Cap: $ 5,000,000 USD

Currency: BTC, ETH, BCH, LTC and Fiat Money

Pre-ICO ThinkCoin will be open to the public on Tuesday 3 April! Pre-ICO activated at 90,000,000 tokens before price increase during ICO. Register now for access to Pre-ICO prices! https://www.thinkcoin.io/

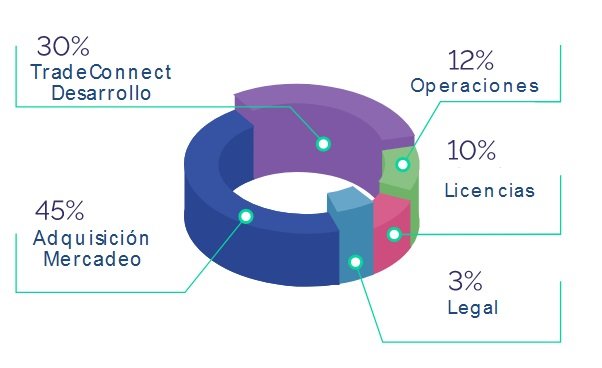

This is the general distribution scale:

If there is anything about our project is not clear - date, price concept

USE OF FUNDS:

ROADMAP

- April 2018

ICO is closed and TradeConnect Alpha released

- May 2018

ThinkCoin Token (TCO) is listed on the crypto exchange for trading

TradeConnect Network

- July 2018

served in Beta for selected clients

TradeConnect

- August 2018

enabled for cryptocurrency trading

- October 2018

TradeConnect network trading starts in FX and CFD Products

- November 2018

ThinkMarkets joined the TradeConnect network and started its retail users

- December 2018

Approximate approval from TradeConnect US Exchange License

- January 2019

TradeConnect began offering trades in equities, commodities, futures and other products.

- March 2019

TradeConnect allows trading in physical equity for investors in Japan, Europe and Australia

- July 2019

IPO TradeConnect

TEAM

- Nauman Anees - CEO and Co - Founder

- Faizan Anees - Director and Co Founder

- Michael Herron - OSC

- Adil Siddiqui - CCO

- Caroline Olsen - Marketing Manager

- Keith Goldson - Marketing Consultant

- Alla Polyanskaya - Audit and Compliance Manager

- Naeem Aslam - chief market analyst, ThinkMarkets

- if Ryan - Head of Sales and Partnership - Europe ThinkMarkets

- Mark Gosha - Senior Project Manager

- Jai Bifulco - Marketing Director, ThinkMarkets

- Harley Salt - Director General of ThinkMarkets

- Andrew Lowry - Director of Public Relations and Content

- Imane Benhima - Digital Marketing Manager

- Jacob Galea - Sales Chief Sales Officer, APAC

- Atanas Tashev - Head of Mobile Team

- Hristo Katsarski - Senior Java Developer

- Martin Benkov - Director of Development

- Panayot Stoyanov - Head of Design and UI / UX

- Aldin Music - Engineering Manager IT

- Strahil Shorgov - Senior Software Developer

- Alexandra Laleva - TradeConnect Product Manager

- Atanaska Ilieva - Web and Digital Designer

Advisor

- John Farrell

- Marek Kirejczyk

- Sena Gbeckor-Kove

- Christina Czeschik

- Cal Evans

- Rodolfo Festa Bianchet

- Jay Best - President, Cogni Capital

- Paul Hill - Non Executive Director, ThinkMarkets

- Lidia Dumatrascu - Socia, VentureBoost Group

- Yagub Rahimov - CEO, 7marketz

- Ashley Aberneithy - CEO, analytics .ai

- Ben Swann - Director, analytics.ai

- Natallia Hunik - Director of Global Sales, Continued Market LLC & Fortex, Inc.

FOR MORE INFORMATION:

Twitter: https://twitter.com/ThinkCoinToken

Facebook: https://www.facebook.com/ThinkCoinToken/

White paper: https://docsend.com/view/5rxxi9c

Telegram: https://t.me/thinkcointoken

Instagram: https://www.instagram.com/thinkcoin/

author: muhammadsosa

eth: 0x8056b4866D50eBCE01D33EDc967D38a6Bf724420

Tidak ada komentar:

Posting Komentar