Equitybase is an end-to-end commercial property ecosystem of project appraisal, credit risk and liquidity that is entirely based on blockchain. With EquityBase, developers and fund managers can offer asset-backed investment opportunities to investors around the world.

Used in investments or trades when you buy stock capital tokens at an equivalent price, without paying any fees on our platform. Participants worldwide can use our platform to invest and diversify their portfolio along with liquidity in the market, but also generate private market revenues. With the support of our specialists with years of experience and reputation in the real estate, consumer electronics and high technology industries, we have collected a $ 300,000 Round Seed in EquityBase. Over the past 15 years, we have created and published high profile corporate web sites with extensive real estate and start-up experience.

In the summer of 2018, full functionality will be introduced on our equity base platform. If a participant can invest in a commercial real estate together and receive a dividend from a lease, we will roll with the asset satisfaction perfectly in accordance with the agreement and pay for the crypto currency or currency along with the liquidity of the traditional public market. In autumn 2018, iOS and Android will also be available reliably for our platform users with full functionality from our site on their mobile devices.

Equitybase has a simple solution: to give everyone the opportunity to invest in high quality commercial real estate, with stock liquidity and income from private equity investments combined with no lock-in period and no intermediaries. Equitybase will offer a diversified real estate investment platform available directly to anyone online. Equtybase will make the investment process in the highest quality commercial real estate from around the world simple, efficient, transparent and fully liquidable.

Equitybase believes that one of the most revolutionary applications of Blockchain technology will be in Real Estate and the exchange industry. The use of Blockchain and smart contract technology in the real estate sector has the potential to truly revolutionize the sector, providing full direct access to real estate investments worldwide, along with lowering entry barriers and increasing market liquidity (which is usually only seen in the public market) . The Equitybase platform will utilize the Hybrid Market system that enables high annual returns from the private market system along with general market liquidity.

Commercial Real Estate is one of the most dynamic investment classes in the world. Commercial Real Estate is the only major asset class that produces high yields and significant equity accumulation. It can be exploited efficiently for big profits and has asset security in the form of goods you can see and touch (intrinsic value regardless of revenue stream). It can also provide some of the best tax advantages.

Equitybase is committed to implementing Ethereum-based Blockchain and Smart Contract Technology in their systems. The main investment objective of equitybase is to focus on super cities like New York, Los Angeles and expand to other markets such as Hong Kong and London in the near future. Each of these markets has the potential benefits of positive trends including: Consistent Growth Rate, Value Stability, High Demand, Minimum Downside Risk, Easy Application of Investment.

What is the current problem of the investment model?

- Liquidity for the private market (equity investment has a vesting period of 3-10 years).

- Availability of funding (developers can only get funding in the country).

- Borrowing costs (interest rates depend on region and developer's own funds).

- Accessibility (Commercial investment requires many start-ups).

- Low Income (stock market over the past 10 years averages 7% of profit per year).

- High Management Costs (Private capital management costs are 2-4% per annum).

What solution does this project team offer?

World Access (developers from around the world can publish their projects on our Equity Invest platform and raise capital with sufficient capital)

There is no minimum investment (investors can invest a limited number of options without limiting investment)

Credit Rating System (investor can track achievement and track record developer)

Liquid Investment (our Exchange Platform gives investors the flexibility to liquidate their assets for each investment)

Zero Investment Duty (token holder investment base can use platform without commission when dividends from Joint Stock Fund received)

Target Dividends and Returns (Volume of investments in commercial real estate offers high profitability and dividends from databases for each asset class worldwide)

Platform Equity Platform Technology

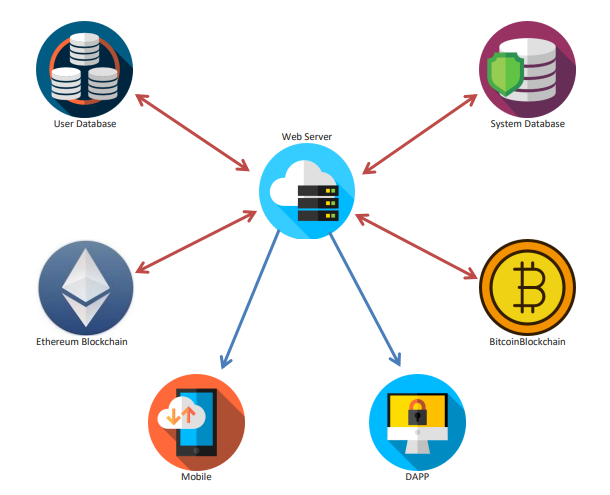

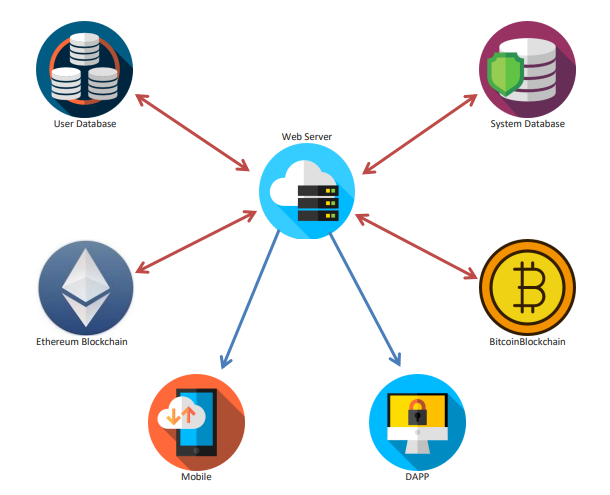

The Equity base platform is a standalone P2P network protocol protocol to digitize real estate into a decentralized Network system governed by the Ethereum smart contract that enables application and

implement preset guides for entities to interact in asset tokenisasi. The platform is being designed with the first mobile approach and strong emphasis on UX / UI user experience / interface, allowing easy access and providing the most relevant information to its users.

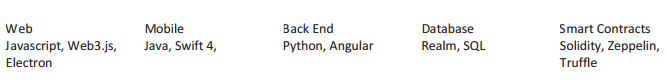

The equitybase platform software component uses the following technologies:

Smart Mobile Smart End Contract Web Javascript

The Equity base platform is a standalone P2P network protocol protocol to digitize real estate into a decentralized Network system governed by the Ethereum smart contract that enables application and

implement preset guides for entities to interact in asset tokenisasi. The platform is being designed with the first mobile approach and strong emphasis on UX / UI user experience / interface, allowing easy access and providing the most relevant information to its users.

The equitybase platform software component uses the following technologies:

Smart Mobile Smart End Contract Web Javascript

- Web3.js

- Electron Java

- Swift 4

- Python

- Natural Angle

- SQL Solidity

- Zeppelin

- Truffles

Equitybase platform software components use the following technologies:

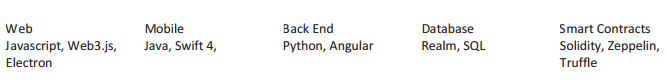

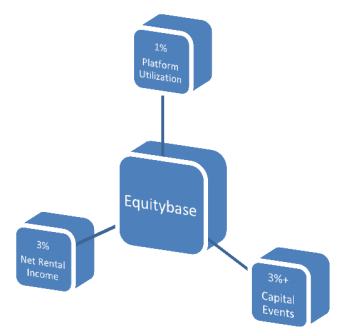

Equity Base Income

Equitybase will earn up to 2% of net income from general income and 2% + of capital events. Equitybase will charge a 1% fee for a list of platforms for real estate developers and sponsors interested in registering their prospective properties on our platform. Investors and sponsors can reduce or override costs entirely by earning an equivalent amount of BASE tokens.

Rental Revenue

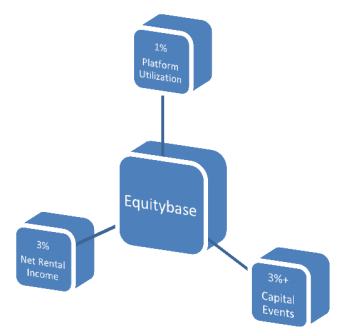

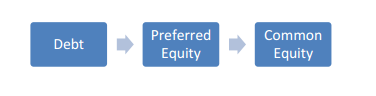

- Cash flows from operations should be distributed in the following order:

- Payment of senior debt payments

- The current payment is preferably returned to REO

- Residual proceeds for all shareholders of the general agreement level

Capital events

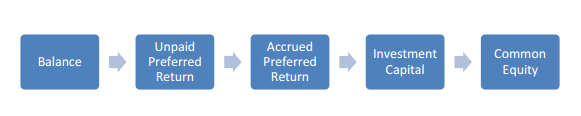

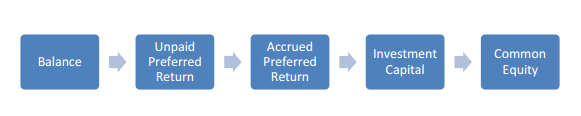

- The proceeds from a capital event should be distributed in the following order:

- The result of outstanding loan balance

- Payment to REO from current unpaid preferred returns

- Payment to REO of the desired return in arrears

- Return the invested capital to REO

- Residual proceeds for all shareholders of the general agreement level

Equitybase ICO

BASE: EquitybaseERC20 Token

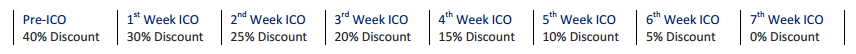

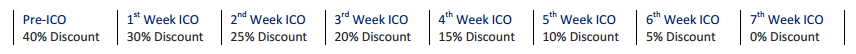

The ICO Public from BASE Token will begin on 02/28/2018 and end on 05/22/2018 with an initial discount of 30%, the discount rate will be lower by a multiple of 5% weekly during the duration of ICO sales. The minimum contribution during public ICO is 0,001 ETH. The transfer rate is set at $ 0.28 / Per BASE Token.

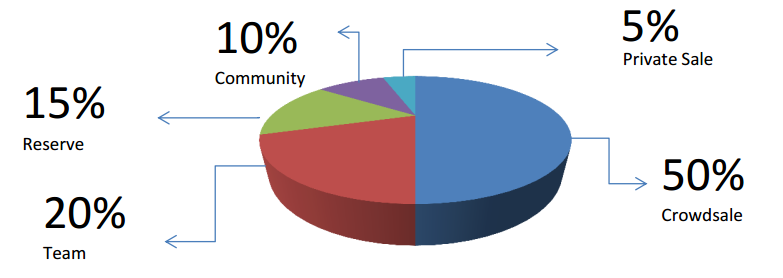

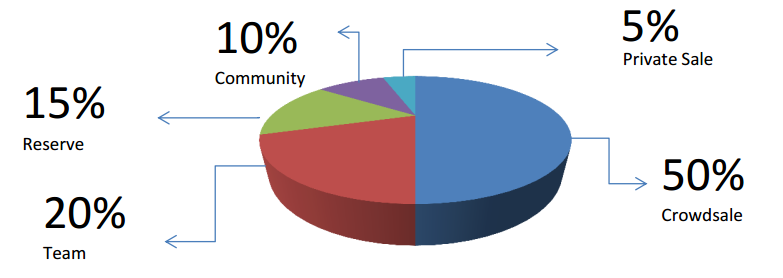

Token Distribution

ROAD MAP

3K / 2017

- Company Formation

- the formation of equity

- Team formation. The first step in the development of platform architecture is equitybase.

4kV / 2017

- Financing

- Development

- Initial Capital: $ 300,000

- Start platform development

1Q / 2018

- Crowdsale

- Pre-sale of individuals

- Pre-IKO

- Public IKO

- Demo version of the platform will be released

- Front-End and Back-End development, API testing

2KB / 2018

- Dividend

- Release Platform Release

- beta version of Equity Invest

- Exchange of basic marker lists

- Liquidity aggregation of several exchanges Crypto currency is created

3KB / 2018

- Development

- User acquisition

- Launch Mobile App

- Partnership and attract users

- Detailed credit rating and reporting, integration

4kV / 2018

- Expansion

- Establish a regional office in London, Shanghai

- Expansion of proposals for hedge funds and private equity funds

- Equity fund IKO

- Change FIATA money instantly

TEAM

Morgan M. Chan

Founder / CEO

Sapphire partner capital capital of a commercial real estate development company with $ 100 million under management. He started working and some IT and electronic goods since 2000.

Connie Yiu

Founder / Marketing Director

Earlier in the dollar shaving club as a manager of social networking, managing all aspects of social marketing. Pickup DSC Unilever in 2016 for $ 1 billion. Before the DSC, he was in newegg, as a marketing manager.

Lee Lois

Chief Advisor

Rates A. Cordovez

Contract Developer "Smart"

Trust cheung

Community manager

Booyon Choi

Law advisor

The principle in the capital is Tsoi's law

Eduard Gubarik

Commercial Financial Advisor

Common partner loan developers

Christian Rokitta

Finteh's Advisor

Founder of insoro

MORE INFORMATION:

AUTHOR: cobaahyuk

eth: 0x8056b4866D50eBCE01D33EDc967D38a6Bf724420

Tidak ada komentar:

Posting Komentar