The Invox Finance platform is an invoice loan platform that enters the invoice financing industry worth US $ 2.8 trillion.

The team at ABR Finance Pty Ltd is behind Invox Finance. ABR Finance is a successful invoice finance company and has helped fund businesses across Australia with A $ 30 million in invoicing.

ABR will also become the first customer of Invox Finance, enabling some sellers and buyers to test the Invox Finance Platform with ABR Finance as a leading investor.

Who will use the Invox Finance Platform?

- Sellers that have invoices they want to sell to accelerate their cash flow

- Investors seek higher returns and diversify their investment portfolios

- Buyers who will receive an invoice payment period are renewed and rewarded for verifying the invoice.

Advantages of Invox finance

- No barriers Confidence and transparency between all parties is achieved through a system of access, verification and controlled remuneration.

- Low rates for sellers. Vendors will be able to seek financing at lower interest rates than traditional investors usually offer.

- Variety for investors. Investors will have access to investment products, which are usually only available to banks and financial companies.

- Dynamic invoice Dynamic invoices allow all parties to update information about invoices in real time, ensuring unchangeable access and control of confidential information.

- Seller associations and investors. Vendors will have direct access to individual investors. The new distributed environment for peer-to-peer lending will benefit both sellers and investors.

- Fragmented Loans Loans for invoices will be fragmented, so investors can buy loans from larger pools, increase diversification and reduce overall risk levels.

Features Invox Offered

- The Invox Finance platform will enable sellers, buyers, investors, and other service providers to directly link, interact, share and distribute information;

- Sellers will be able to obtain financing at lower interest rates than those normally received from traditional investors operating outside blockchain;

- Dynamic invoices provide all parties with the ability to update invoice information in realtime, ensure conservation and manage access to sensitive information;

- The Invox Finance platform will give sellers direct access to individual investors;

- The Invox Finance platform will expose investors to loan products consisting of loan fragments from various businesses in various industry sectors;

- Credit invoices will be fragmented into smaller ones allowing investors to purchase loan fragments to reduce their risk profile and increase their diversification.

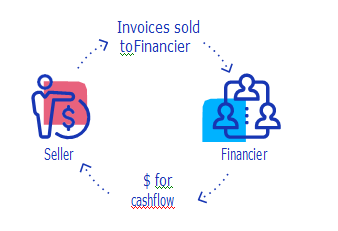

How Invox Finance Works

First Transaction

Billing is based on buyer's invoice from the seller.

Once the financiers approve the seller for an invoice financing facility, the financier will agree to advance the money to the seller against each invoice. When the seller issues an invoice to the buyer, the seller will request funding from the party financing this invoice (typically up to 80% of the face value of each issued invoice). The financier will then advance the agreed amount to the seller.

Financiers will rely on invoices to be paid directly to them by the buyer in time, in order for their financial loans to be repaid.

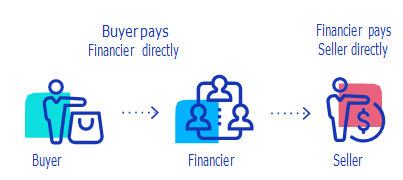

Second Transaction

The financier will then require that payments for all issued invoices be made into bank accounts controlled by the financiers.

Sellers need to notify their customers (buyers) of new bank account details and all future invoice payments must be made to that account.

Third Transaction

When a financier receives a full payment for a funded invoice from a buyer, it will return the balance of the invoice value to the seller less the cost. Usually this is 20% less cost or any interest.

Invox Finance Distributed Platform enables creation of dynamic invoices in ledgers distributed, providing increased trust, transparency, efficiency and security for all involved with minimal cost. Invoice fragmentation allows investors to spread their risk across hundreds of invoices, allowing for low risk investments, maximum returns.

The founders of Invox Finance have many years of experience managing a successful accounting firm in Australia - ABR Finance. ABR Finance has been in operation since 2012 and has assisted businesses across all Australian billing companies with AUD30 million in various industries including IT, wholesale, construction, transportation, engineering, employment, publishing and professional services. ABR funding will also work with the Invox Finance Platform to provide the first leading investor investor.

Currently there is only one other competitor in the field - Populous Invoicing Discounts, which have a market capitalization of more than $ 800 million at the time of writing. Invox Finance respects the goals the Populous team wants. The current centralized accounting environment needs to be disrupted and both Invox Finance and Populous are at the forefront.

Current accounting methods are stagnant and require improvement. Invox Finance solves this:

- Lack of contact between the parties involved

- Transparency issues around the process

- security issues

- Risks to investors

- risk of fraud

by creating dynamic invoices in distributed ledgers that connect buyers, sellers, and investors across the process.

Invox differs from Populous in this case:

- Buyers' involvement in the platform

- Dynamic creation, not static paper-based invoices

- Same access for investor (no offer on invoice)

- fragmentation of credit

- More experience in invoice financing

How the Invox Finance Platform solves the problem

The Invox Finance platform is a decentralized peer-to-peer invoice loan platform that will allow sellers, buyers, investors, and other service providers to directly connect, interact, share and distribute information. The platform aims to create an environment of mutual trust by facilitating transparency between parties and satisfactory performance.

This platform will disrupt and revolutionize traditional invoice financing by implementing a system in which trust and transparency between all parties are developed through the rewards system it contains.

In addition, the execution of transactions and the flow of information will not depend on a single centralized service provider, but rather governed by a set of transparent rules implemented on a fully distributed ledger

Why Should Invox Finance

- Platform Decentralized Platform

Invox Finance will enable vendors, buyers, financial specialists and other specialists to communicate with each other, connect, share and share data directly.

- Lower Price for Seller

Sellers will be able to obtain financing at low interest rates than those normally received from traditional investors operating outside blockchain.

- Dynamic Invoice in Distributed Ledger

Dynamic invoice supply for all meetings with the capacity to refresh data reception in realtime, ensuring unchanged and monitoring sensitive data.

- Bringing All Parties together

The Invox Finance platform maintains trust and candor between all meetings through permitted access, confirmations, and a fabrication prize framework.

Invox Token

Invox Tokens will be generated in general ledger using the ERC-20 standard and will have the following utility "

- will grant access to the Invox Finance Platform for sellers. That is, every Seller will be required to pay a certain amount of Invox Tokens each year to gain access to the platform, and

- gift work done for the platform. This means the system will reward buyers and sellers with Invox Tokens for verification and invoice payments.

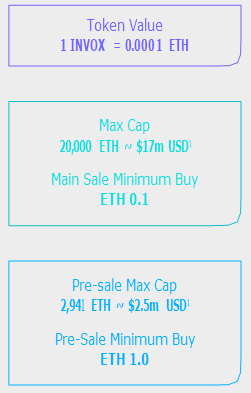

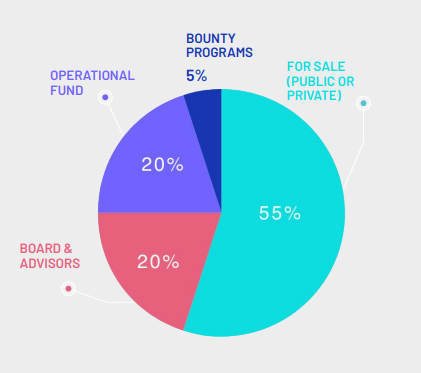

The final amount of Invox Token printed will be released on our website www.invoxfinance.io. In addition to tokens sold during ICO, 20% tokens will be set aside for founders and advisors, 20% token set aside for operational funds and 5% set aside for gifts and airdrop.

There will be no Invox Token created after ICO is complete.

Details of ICO & Token

The reason behind doing ICO is to pre-sell membership to the system through the sale of Invox Tokens. While the seller may obtain middle or upper level membership either through the purchase of Invox Tokens or get them through prizes for verification and invoice payments, initially all sellers must purchase Invox Tokens (either on ICO at

discount rates or from the Invox Finance Platform) to be able to pay their annual membership and access the Invox Finance Platform. For this reason, there should be an initial token inventory when the Invox Finance Platform is introduced.

The maximum possible inventory amount for Invox Tokens is 464,000,000. This is based on possible maximum bonus rate, maximum allocation (as listed above) and token conversion of 1ETH = 10,000 INVOX. It should be noted that the average bonus rate across ICO will be lower than the maximum possible bonus rate. For this reason the total supply is likely to be lower. For more information, please visit www.invoxfinance.io

.Citizens and residents of the United States, China, or citizens of any country that prohibits ICO or cryptocurrency will not be able to participate in the ICO.

Allocation of Invox Token

Token Sales Phase

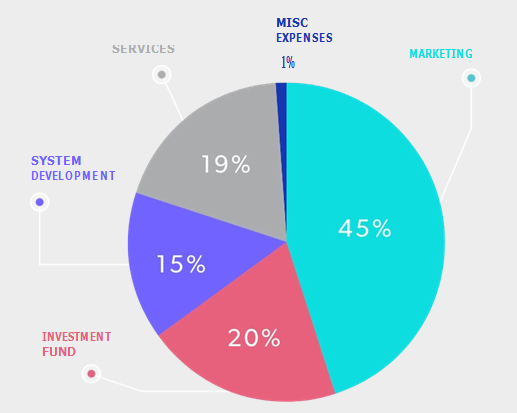

Budget allocation

Why do you need a token?

With Invox Token, you can access the Invox Finance system and perform various actions. Invox tokens are also used to differentiate platform users in two ways. they rate buyers when they review and reward buyers and sellers after paying bills. During ICO, 1 INVOX = 0,0001ETH, and minimum purchase requirements of 0.1ETH for pre-sale and home sales. Presale still running. Click https://ico.invoxfinance.io/ to sign up

ROAD MAP

TEAM

ADVISORS

FOR MORE INFORMATION:

WEBSITE || FACEBOOK || TWITTER || WHITEPAPER || TELEGRAM || BITCOINTALK || BOUNTY || MEDIUM || GITHUB || REDDIT

author: muhammadsosa

eth: 0x8056b4866D50eBCE01D33EDc967D38a6Bf724420

Tidak ada komentar:

Posting Komentar